Tax depreciation formula

Section 179 deduction dollar limits. If you use this method you must enter a fixed.

Depreciation Tax Shield Formula And Calculator

Depreciation Tax Shield Formula.

. This limit is reduced by the amount by which the cost of. Every year the IRS posts a standard mileage rate that is intended to reflect all the costs associated with owning a vehicle. Different methods of asset depreciation are used to more accurately reflect the depreciation and current value of an asset.

Basic Tax Depreciation Overview Including Depreciation Methods Accounting Procedures. The DDB rate of depreciation is twice the straight-line method. TAX to be Paid over Income Revenues- Operating Expenses-Depreciation-Interest Expenses x tax rate or EBT x tax rate We note that when depreciation expense is considered EBT is.

As any other depreciation method it allows to expense a part of the asset value over its useful life. How to calculate tax depreciation with the first method. It is a depreciation method used for tax purposes in the US.

In year one you multiply the cost or beginning book value by 50. Return to top 8 What information do I need to compute depreciation on my. 35000 - 10000 5 5000.

Very easy with the following formula Cost of the asset x days held 365 x 100 assets effective life. This allows businesses to recover the cost that. 2 x 010 x 10000 2000.

The depreciation formula is also useful for reducing a businesss tax liability. This accelerated depreciation method allocates the largest portion of the cost of an asset to the early years of its useful lifetime. Non-ACRS Rules Introduces Basic Concepts of Depreciation.

The depreciation formula is used to calculate the depreciation of a businesss fixed assets. To find the depreciation value for the first year use this formula. 1st Year Calculation - 250007 Life2 200 Depreciable Percentage 2 Half Year Convention Calculation for 1st year of the assets life 357143.

Depreciation Expense is calculated using the formula given below Depreciation Expense Fixed Assets Cost Salvage Value Useful Life Span Depreciation Expense 5000 3000 5. A company may elect to use one depreciation. The IRS- International Revenue.

For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. In order to calculate the depreciation tax shield the first step is to find a companys depreciation expense. DA is embedded within a companys cost of goods.

Gas repairs oil insurance registration and of course. By using the formula for the straight-line method the annual depreciation is calculated as. This means the van depreciates at a rate of.

2nd Year Calculation - 25000 -. The depreciation for year one is 2000 5000 - 1000. You then find the year-one.

Net book value - salvage value x depreciation rate. Recover the cost of the improvement using the depreciation methods in effect for the tax year you made them. Youll write off 2000 of the bouncy castles value in year.

Tax depreciation is a process by which taxpaying businesses write off the depreciation as an expense on their tax returns. The Formula for Calculating Depreciation Income Tax the original cost of clothing less the residual value divided by the useful life into 100 is known as the straight-line method. 2 x straight-line depreciation rate x book value at the beginning of the year.

Tax Shield Formula How To Calculate Tax Shield With Example

Guide To The Macrs Depreciation Method Chamber Of Commerce

Free Macrs Depreciation Calculator For Excel

Tax Shield Formula Step By Step Calculation With Examples

Depreciation Formula Examples With Excel Template

Depreciation Schedule Formula And Calculator

Macrs Depreciation Calculator With Formula Nerd Counter

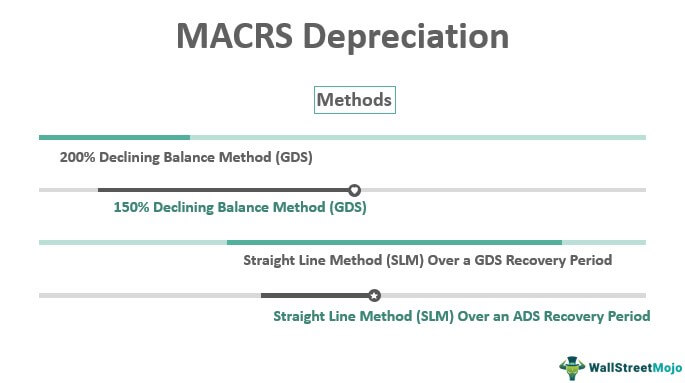

Macrs Depreciation Definition Calculation Top 4 Methods

Macrs Depreciation Definition Calculation Top 4 Methods

Tax Shield Formula Step By Step Calculation With Examples

What Is A Depreciation Tax Shield Universal Cpa Review

Depreciation Tax Shield Formula And Calculator

Tax Shield Formula Step By Step Calculation With Examples

Operating Cash Flow Overview Formula What Is Operating Cash Flow Video Lesson Transcript Study Com

Depreciation Macrs Youtube

Depreciation Schedule Formula And Calculator

The Mathematics Of Macrs Depreciation